Researching multiple insurance companies to compare prices

Checking for discounts and promotions

Improving your credit score to qualify for lower rates

Reducing your coverage limits or.

Researching multiple insurance companies to compare prices

Checking for discounts and promotions

Improving your credit score to qualify for lower rates

Reducing your coverage limits or deductibles

Working with an insurance agent to negotiate the best raMost Tennessee drivers who need SR22 insurance - insurance carriers must comply with the state's specific laws and regulations. You'll need to understand Tennessee regulations regarding SR22 insurance to guarantee you're meeting the requirements.

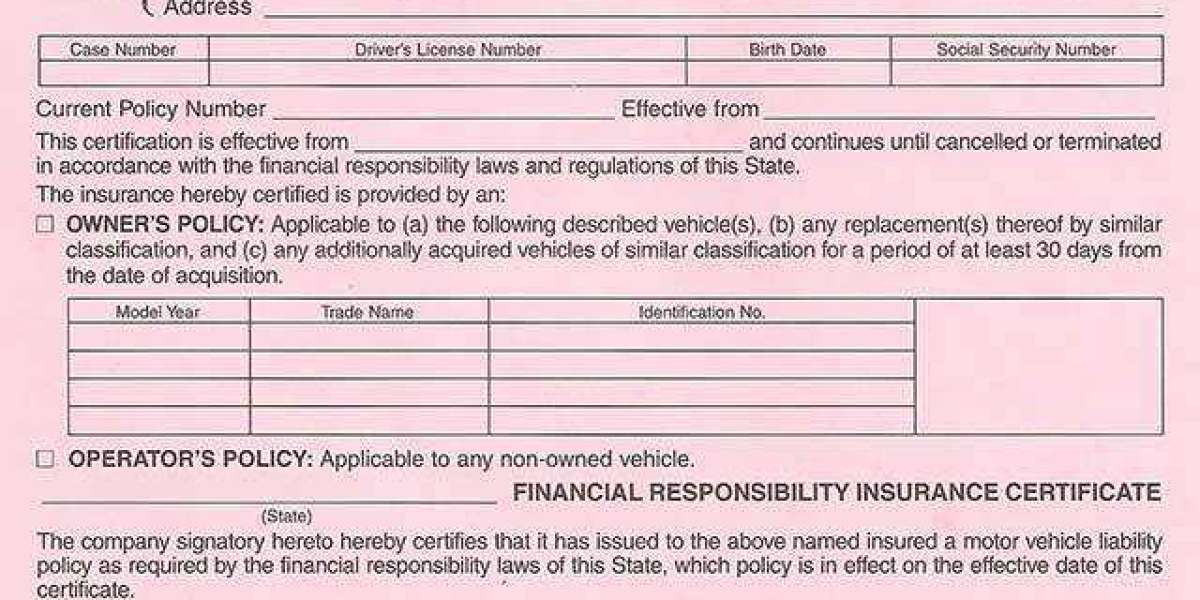

Budget-friendly SR22 insurance Tennessee. The state of Tennessee mandates that drivers who've had their licenses suspended or revoked due to certain offenses must file an SR22 form with the state department of motor vehicles. This form verifies that you have the minimum required state insurance covera

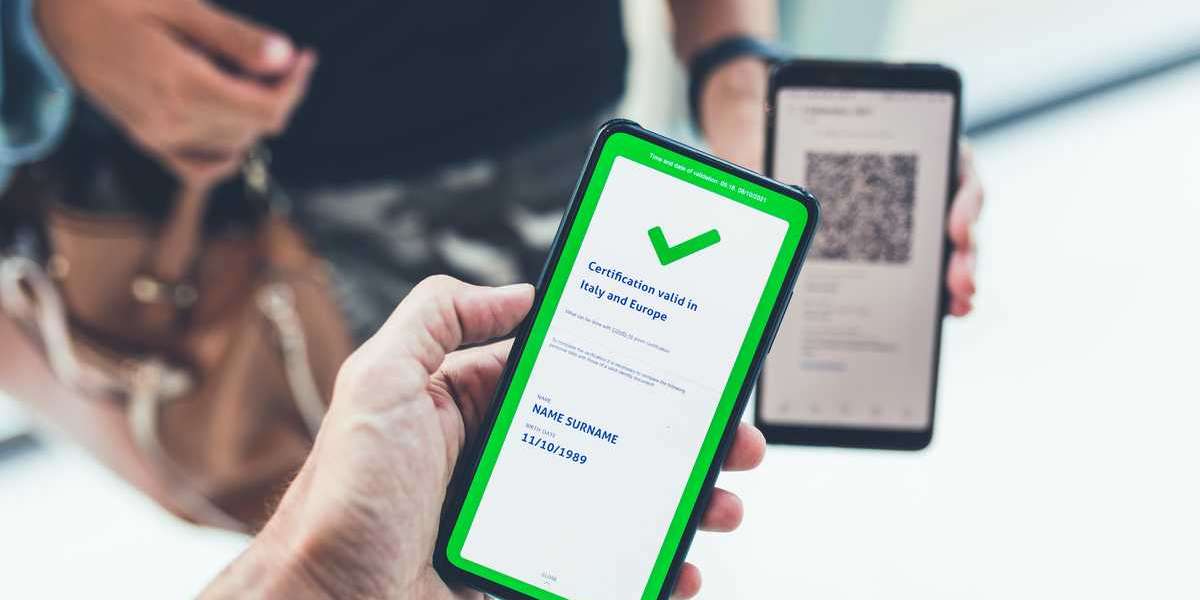

You'll need to carry SR22 insurance in Tennessee if you've had a serious driving offense, like a DUI. You must file an SR22 form with the state, maintaining minimum policy limits - Budget-friendly SR22 insurance Tennessee of $25,000 bodily injury per person, $50,000 per accident, and $15,000 property damage. Comparing quotes - insurance carriers from multiple insurers helps you identify cheap coverage options. insurance carriers. You can also opt for minimum coverage or improve your driving record to reduce costs - insurance carriers. As you assess your options, you'll uncover more ways to find affordable SR22 insurance that meets Tennessee's requirements and fits your budg

You're looking for low-cost options to obtain SR22 insurance in Tennessee, and you'll find that several providers offer cheap rates. When comparing quotes, you'll want to evaluate factors such as coverage limits, deductibles, and policy duration to guarantee you're getting the best rate. You can start by researching insurance companies that specialize in SR22 insurance, as they often provide more competitive pricing and customized coverage option

With your driver history in mind, it's time to contemplate how the type of vehicle you drive impacts your SR22 insurance rates in Tennessee - personal automobile liability insurance policy. You'll find that sports cars, known for their high performance, typically increase your insurance rates due to the higher risk of accidents. On the other hand, electric vehicles are generally considered safer and more environmentally friendly, which may lead to lower insurance rat

Compare quotes from multiple Tennessee SR22 providers.

Fast approval processes reduce downtime.

Cheap rates available with discounted plans.

Immediate coverage activates upon approval.

Online tools facilitate easy quote comparisonMost drivers don't realize that their coverage limits play a significant role in determining SR22 insurance rates in Tennessee. You're likely aware that SR22 insurance is a requirement for drivers who've had their licenses suspended or revoked, but you might not know how your coverage options impact your rates. When you're shopping for cheap SR22 insurance in TN, it's vital to take into account your policy limit

When comparing rates, you'll notice that some insurers offer premium discounts for certain driver characteristics, such as a good driving record or completion of a defensive driving course - insurance carriers. You can take advantage of these discounts to lower your SR22 insurance costs. It's crucial to assess all the factors that affect your insurance rates, including your driving history, vehicle type, and coverage limits. By carefully evaluating these factors and comparing rates from different insurers, you can find an affordable SR22 insurance policy that meets your safety needs and complies with Tennessee's requirements. This will help you get back on the road safely and legal

Now that you've evaluated your policy coverage options, it's time to focus on strategies to save money on your SR22 insurance in Tennessee. You're looking for ways to reduce your premiums without compromising on safety. One approach is to investigate discount programs offered by insurance providers (personal automobile liability insurance policy). These programs can offer significant savings, especially if you have a good driving record or complete a defensive driving cour

While you're likely familiar with standard auto insurance, SR22 insurance serves a distinct purpose. It's not a type of insurance, but rather a certificate that proves you have the required insurance coverage. You'll need to meet SR22 requirements if you've had your license suspended or revoked due to a serious offense, such as a DU

To initiate the

SR22 insurance TN filing process in Tennessee, you must first obtain an SR22 insurance policy from a licensed insurer, which will then file the required forms with the state's Department of Motor Vehicles on your behalf. This insurer will handle the document submission, making certain all necessary paperwork is completed accurately and submitted in a timely manner. You'll need to provide required information, such as your driver's license number. insurance carriers and vehicle details, to facilitate the filing proce

Innovation Amid Crackdown: Exploring Nigeria's Dynamic Sports Betting Landscape

द्वारा thedablunt9769

Innovation Amid Crackdown: Exploring Nigeria's Dynamic Sports Betting Landscape

द्वारा thedablunt9769 Hướng Dẫn Cho Bạn Cách Soi Kèo Phạt Góc Cược Chấp

द्वारा phocohanoi2

Hướng Dẫn Cho Bạn Cách Soi Kèo Phạt Góc Cược Chấp

द्वारा phocohanoi2 A Peek At The Secrets Of Auto Vacuum And Mop

द्वारा robotvacuummopsuk2931

A Peek At The Secrets Of Auto Vacuum And Mop

द्वारा robotvacuummopsuk2931 By Harnessing the Ability Of Vibrations

द्वारा opheliareddy4

By Harnessing the Ability Of Vibrations

द्वारा opheliareddy4 Guide To Private Psychiatrist Assessment Near Me: The Intermediate Guide To Private Psychiatrist Assessment Near Me

द्वारा iampsychiatry6660

Guide To Private Psychiatrist Assessment Near Me: The Intermediate Guide To Private Psychiatrist Assessment Near Me

द्वारा iampsychiatry6660